Tourists from Beijing, Shanghai and Guangzhou like to travel in comfort when they go overseas, with more travelers seeking information and booking their trips on the Internet.

The Nielsen China Outbound Travel Monitor, a research system established by global information and media firm The Nielsen Co to survey mainlanders on their overseas trips, found that more than one-third of the 1,500 surveyed Chinese outbound travelers chose to stay in four-star hotels, with a further 10 percent opting for five-star luxury accommodation when heading overseas.

Conducted in October with a combination of telephone and online interviews, the Nielsen China Outbound Monitor provided insight into mainland travelers from these three key cities, which highlighted their travel behavior and attitudes and opinions toward various destinations, and offered an insight into the decision-making processes, information sourcing, booking choices, accommodation and more - for both leisure and business travel.

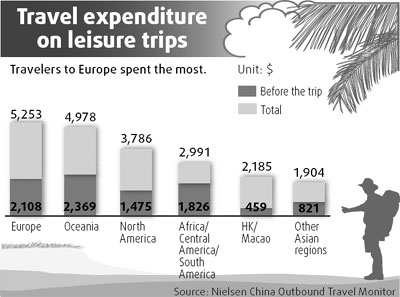

The survey found mainland outbound travelers last year spent on an average close to $3,000 per trip per person, including expenses prior to the trip, such as prepaid packages, airfares and accommodation.

Travelers to Europe were the biggest spenders, splashing out an average $5,253 per trip, while travelers to Asia spent around one-third of that amount, the exception being those headed for Hong Kong and Macao.

Expenditure of visitors to the two special administrative regions was $2,185 per person on average, reflecting their shopping and entertainment paradise status.

"Asia remains the most popular destination for Chinese travelers because of the region's proximity. However, trips to Europe and the United States are increasing rapidly, particularly when it comes to business travel," said Grace Pan, head of Travel & Leisure Research for The Nielsen Company China.

"We also found that while mass-market travelers focus on budget travel, there is a fast-emerging affluent segment prepared to indulge in luxury travel."

With China supplying millions of visitors to overseas destinations, operators in these countries will need to shape their strategies accordingly to cater to this unique and high-potential group of customers and benefit from the growing opportunities presented by them, Pan said.

Chinese consumers are becoming increasingly sophisticated and the travel industry needs to monitor changes and trends in their travel preferences, attitudes and perceptions toward various destinations," Pan said. "While Chinese travelers appear to seek comfort, they are also becoming wise and well prepared as they plan their trips leveraging all the information available to them on the Net."

Another survey of The Nielsen China Outbound Travel Monitor showed nearly seven in 10 Chinese leisure travelers accessed destination websites, and about six in 10 used online travel forums to source information last year.

Outbound travelers from the three key cities are also turning to the Internet for their travel bookings. The majority, or 61 percent, of those surveyed have used traditional travel agents, 29 percent and 16 percent booked via online travel agents and hotels respectively, with their numbers expected to continue to increase.

"Given the astounding growth in China's online population, the Internet will become the most efficient way to quickly understand consumers across China's vast markets," said Pan.

"The implications of this are twofold - attractive and informative online content will need to influence Chinese travelers in making destination choices, and once those choices are made, an easy and trustworthy mechanism will be needed to facilitate bookings." (By Liu Jie)

Editor: canton fair |